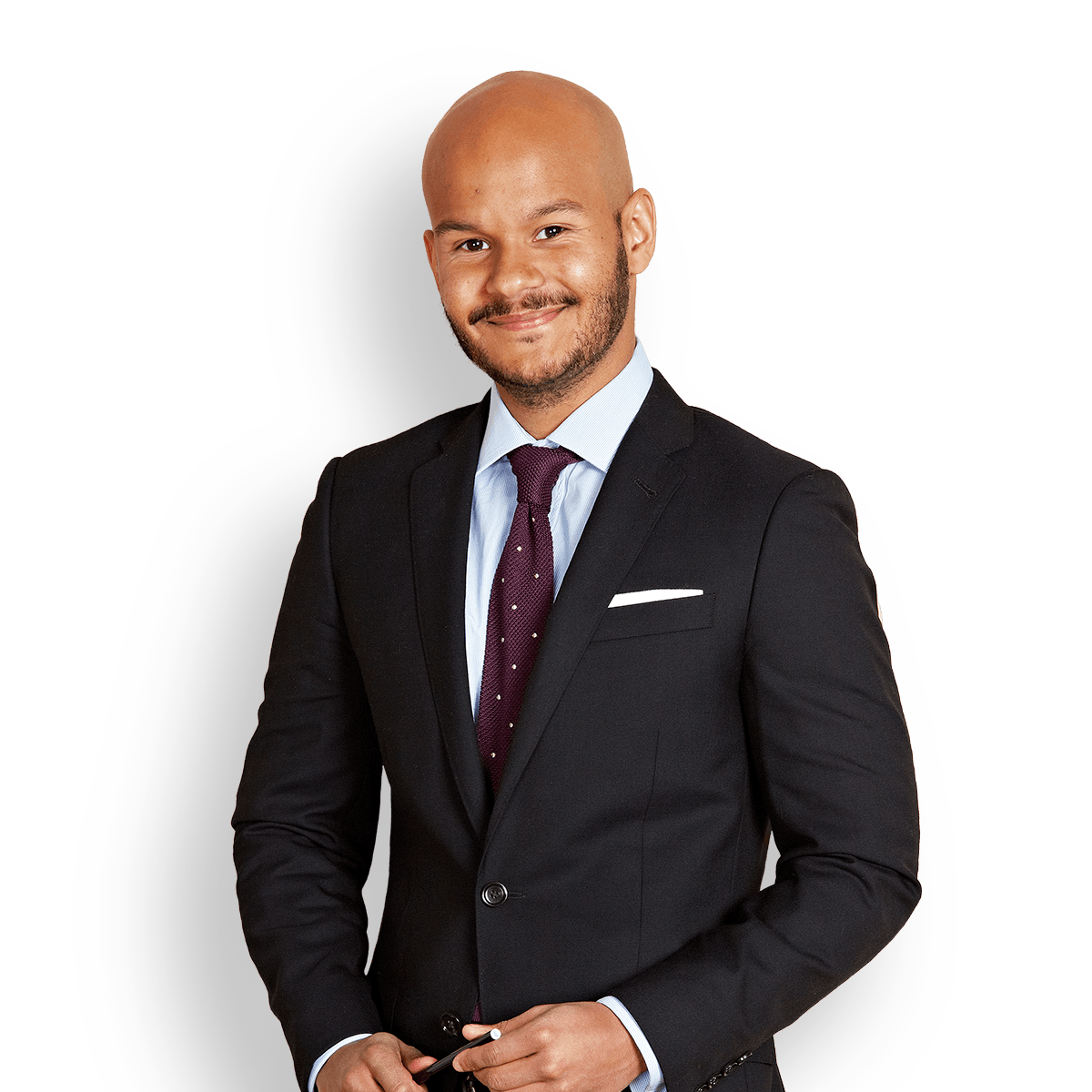

Mikaela Virtanen

Senior Associate, Member of the Finnish Bar

Contact details

I specialise in dispute resolution.

Before joining Castrén & Snellman’s Dispute Resolution service, I worked as a trainee at a law firm specialised in dispute resolution and after graduation as an associate at a boutique law firm specialised in dispute resolution, corporate law and energy law. My areas of practice include both domestic and international court and arbitration proceedings. I worked at Castrén & Snellman as a trainee already in 2017.

I have a Master of Laws degree from the University of Turku. I have also studied law at Lund University, Sweden.